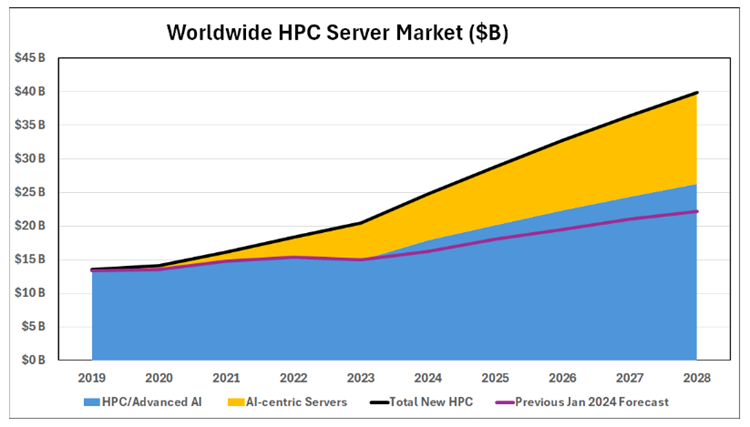

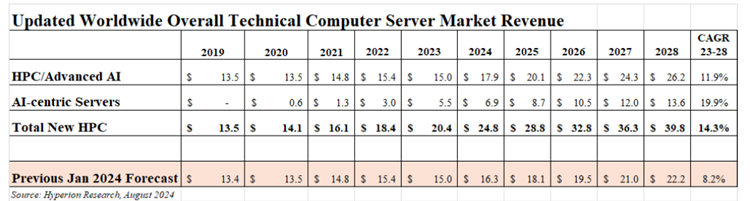

Hyperion Research announced that it has updated its market sizing for the HPC (technical computing servers) market precipitated by the unprecedented impact AI has had on the market. In addition to revenue from traditional HPC suppliers, revenue attributed to non-traditional HPC suppliers, which often comes from non-traditional HPC buyers, is now included. These new types of servers are referred to as “AI-centric Servers” in the figure and table below. This change in scope increases the overall HPC market by 36.7% in 2023 and is projected to add $13.6B by 2028.

According to Earl Joseph, CEO at Hyperion Research: “As AI is being integrated into traditional HPC workflows, and HPC-class machines are being purchased to adopt AI into enterprise datacenter applications, we are seeing a great increase in new buyers and new suppliers that have entered the HPC market.”

The changes to the HPC market sizing and tracking are based on multiple surveys conducted over the last 2 years and represents a major adjustment to the overall HPC market, heavily driven by a combination of the use of AI, Large Language Models, and the purchases of large GPU/accelerator-based systems. HPC systems are used as the backbone for many AI and AI-related applications, which has driven the overall HPC market to a new level of growth.

Market Segment Definitions

AI-centric Servers (new revenues added to the previous HPC market sizing)

These are on-premises AI-centric HPC servers that are provided by non-traditional HPC suppliers like NVIDIA, Cerebras, SambaNova, SuperMicro, etc., frequently at non-traditional HPC user sites like large enterprise sites adding AI capabilities.

- These servers are designed primarily to run AI and AI-related workloads.

- These servers are a subsegment of the overall HPC market but haven’t historically been accounted for within prior HPC market numbers.

HPC & Advanced AI Servers (previously counted in the HPC market sizing)

These are on-premises servers that are used for highly computational or data-intensive tasks:

- Hyperion Research uses the terms technical computing and high performance computing (HPC) to encompass the entire market for computer servers used by scientists, engineers, analysts, and other groups using computationally and/or data-intensive modeling and simulation applications. An on-premises system primarily used for HPC workloads (at least 50%) can be referred to as an HPC/AI system, or simply an HPC. These servers also include AI-centric servers used by traditional HPC end-users and are typically sold by traditional server vendors.

- In addition to scientific and engineering applications, technical computing includes related markets/applications areas such as economic analysis, financial analysis, animation, server-based gaming, digital content creation and management, business intelligence modeling, and homeland security database applications.

- Systems acquired by cloud service providers for the purpose of hosting cloud workloads are excluded, as Hyperion Research separately tracks spending for HPC usage in cloud environments.

- The Advanced AI servers previously tracked are primarily sold by traditional HPC system vendors going to traditional HPC sites.

Sign up for the free insideAI News newsletter.

Join us on Twitter: https://twitter.com/InsideBigData1

Join us on LinkedIn: https://www.linkedin.com/company/insideainews/

Join us on Facebook: https://www.facebook.com/insideAINEWSNOW